Retirement Plan Consulting

Retirement Plan Consulting

At Francis, our nationally recognized investment consultants begin with a promise: to always do what’s in your best interest.* We operate with transparency and collaboration to deliver results that help organizations — and their people — succeed. Our investment manager research opinions and innovative plan design recommendations are developed in-house by our team of CFA Charter holders through an ERISA compliance lens.

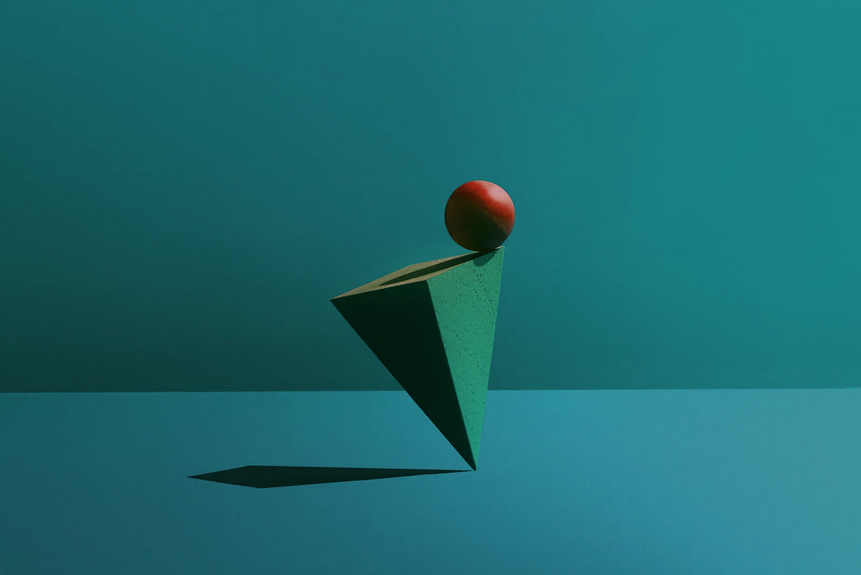

Is Your Retirement Plan Out of Balance?

Is your employer-sponsored retirement plan plagued by low participant engagement? Are you concerned about your employees’ retirement readiness? Are unnecessary fees eroding employees’ investment returns? It may be time to consider a new retirement plan advisor. At Francis, our decades of experience and award-winning advice will proactively help you manage your retirement plan, restoring balance and driving positive change within your organization.

Your Employees. Your Priority.

Building a great company culture includes protecting retirement assets to help employees thrive now and into retirement. By partnering with Francis, we help your employees realize the benefits of their retirement plans and ensure their financial well-being. See how partnering with Francis helped companies pursue the interests of employees and support Work-Life-Money Balance.*

What We Bring

- An award winning team of consultants dedicated to helping you efficiently and effectively manage your organization's retirement plan

- Guidance across all retirement plan areas, from investments and governance to compliance and fiduciary responsibilities

- Proprietary analysis of markets and investments and forward-looking recommendations

- Comprehensive, ERISA fiduciary advice, with an unwavering focus on participants

- Flexible and engaging education programs customized to your company’s needs

- Our promise to always provide advice free from any conflicts — we don’t sell investment products

What We Do

Plan Oversight and ERISA Fiduciary Training

Ongoing training for retirement plan committee and support team members

Plan Cost Management

Detailed analysis of all plan costs and fees, including relevant benchmarking and year-over-year comparisons

Investment Manager Research

In-person site visits to all investment management organizations utilized, viewed solely through the lens of an ERISA fiduciary

Vendor Search

Guided evaluation process of plan service providers, including summary of services and cost analysis as an ERISA fiduciary

PLAN OPERATIONAL REVIEW

Consulting exercise that documents and compares Plan’s provisions with day-to-day operations

Investment Policy Statement

Drafting or revising Investment Policy Statement to establish your organization’s prudent oversight process.

Quarterly INVESTMENT REVIEWS

In-person meetings to discuss industry trends, capital markets outlook and plan cost and performance.

Annual AND ONGOING PLAN BENCHMARKING

Comprehensive plan review measuring plan effectiveness and ERISA complianceIt’s Your Employees' Money

Yet, poor plan design, hidden fees, unnecessary services and bad advice cost unsuspecting organizations and their employees billions every year. In fact, investors are losing up to 10% of their long-term savings due to conflicted advice*. At Francis, we exist to help America’s workers prosper and are structured to ensure that is and always will be our focus.*

Expert. Efficient. Community-minded.

At Francis, our team leads. Our credentialed advisors are invested in your success, consistently receiving high marks from our clients for our customer service, unsurpassed industry knowledge and the results that help their employees and their organizations succeed.