Skip to content

We Walk Alongside You

Francis knows it’s all about balance — Work Life and Money. That’s why each member of the Francis team is so passionate about helping clients and their employees get the most out of their retirement plans and become better family finance managers, so people are empowered in their financial decision-making and achieve the Work Life Money Balance that everyone deserves.

We Walk Alongside You

Francis knows it’s all about balance — Work, Life, and Money. That’s why each member of the Francis team is so passionate about helping clients and their employees get the most out of their retirement plans and become better family finance managers, so people are empowered in their financial decision-making and achieve the Work-Life-Money Balance that everyone deserves.

Michael J. Francis

President | Co-Founder | Principal

- Education: B.A. Economics, Carleton College; juris doctorate, Marquette University Law School

Mike has been the featured 401(k) Adviser columnist for the Milwaukee Journal Sentinel since 1995.

More >

X

Mike has been advising qualified retirement plan clients since 1988. He has been a featured columnist for the Milwaukee Journal Sentinel as the 401(k) Adviser since 1995, as well as a frequent public speaker on retirement plan governance and investment issues. Mike was recognized as one of the top 25 retirement plan advisors in the country by PLANSPONSOR Magazine in 2006 and guided the firm to be named Retirement Plan Adviser (large-team) of the Year in 2018.

Michael J. Francis

President | Co-Founder | Principal

Finding Balance

Work:

I love the company we are building and the mission that drives us: to change the industry by providing conflict-free investment advice to retirement plan sponsors and their employees. It is a joy to come to the office every day and work with such passionate, talented and motivated people.

Life:

My time outside the office is dedicated mostly to my growing family. Spending time with my wife and five adult children is my priority. With kids settled all around the country, traveling to spend time with them keeps my wife and I plenty busy.

Money:

Money allows us to make a difference in the lives of the people and things we care about. It should be invested carefully and spent thoughtfully.

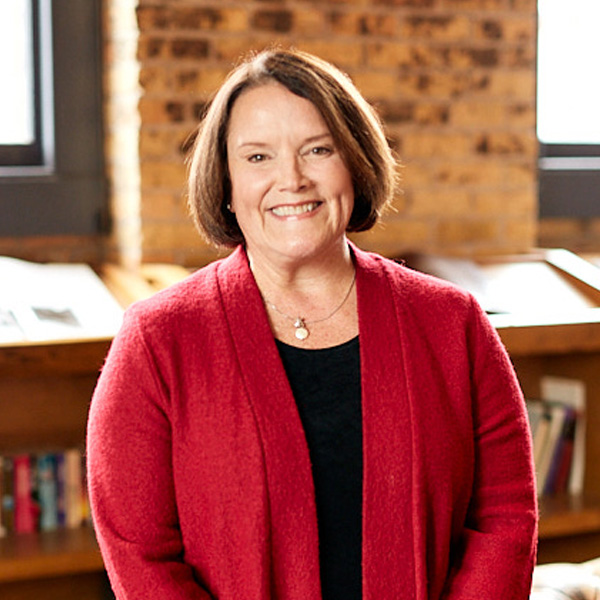

Kelli Send

Co-founder | Principal | Senior Vice President Financial Wellness Services

- Certifications/Designations: CERTIFIED FINANCIAL PLANNER™ Professional (CFP®); Series 65; ERISA Fiduciary

- Education: B.A. Marketing, Michigan State University; M.A. Adult Education, Carroll University

With over 30 years of advising plan participants under her belt, Kelli has extensive financial wellness knowledge and oversees the firm’s financial wellness team.

More >

X

With over 30 years of advising plan participants under her belt, Kelli has extensive financial wellness knowledge and oversees the firm’s financial wellness team. She is responsible for curriculum design and delivery, as well as the firm’s money coaching services. Under her leadership, the financial wellness team has won 18 Eddy Awards for excellence in plan participant education.

Kelli Send

Co-founder | Principal | Senior Vice President Financial Wellness Services

Finding Balance

Work:

I believe that Francis was founded on the principle that the American worker deserves holistic investment and money advice without jargon, judgement, or any hidden sales agenda. Francis does not look down upon anyone or try to sell things, but rather, works alongside the client to look ahead.

Life:

I am a master juggler and know the struggles and joys of managing a career, kids and a household. My happy place is on top of a mountain with boards on my feet (plus Disney World, of course!).

Money:

Ignoring your finances doesn’t make them go away. Just take the first small step. Don’t wait another day.

Cliff Dunteman

Principal | Senior Vice President Investment Consulting Services

- Certifications/Designations: Chartered Financial Analyst (CFA®) charterholder; Series 65; ERISA Fiduciary

- Education: B.S. Business Administration and Finance, Illinois Wesleyan University

Cliff helps clients achieve their goals by providing expert and transparent counsel.

More >

X

Cliff helps clients achieve their goals by providing expert and transparent counsel. With over 30 years of industry experience, he is able to provide extensive insight on retirement plan governance, capital markets, selecting and monitoring investment alternatives, plan design and cost, and the marriage of these with participant outcomes. He works closely with clients to develop programs designed to help employees achieve their goals. He sits on the firm’s investment committee and contributes to the firm’s proprietary research. He also spearheads the firm’s expansion of the Francis brand on a national scale.

Cliff Dunteman

Principal | Senior Vice President Investment Consulting Services

Finding Balance

Work:

While working in asset management, I became too familiar with the multitude of conflicts that exist in the financial services industry. I love being able to act in my client’s best interest at Francis. I love the Francis Way.

Life:

I’m still trying to figure out what I want to be when I grow up: beach bum, ski bum, master barbecue artist, avid kayaker or woodworker. I’m enjoying figuring out what life has to offer with my wife and two kids.

Money:

Start early, stay disciplined and reap the rewards. Doesn’t matter how little you start with, every small amount counts.

Edward Mcllveen

Principal | Chief Investment Officer | Vice President Investment Consulting Services

- Certifications/Designations: Chartered Financial Analyst (CFA®) charterholder

- Education: B.A. History, Gustavus Adolphus College; MBA, Finance, Marquette University

As CIO, Ed leads the firm’s investment committee, which develops strategic and tactical asset allocation.

More >

X

As CIO, Ed leads the firm’s investment committee, which develops strategic and tactical asset allocation and establishes the underwriting criteria for traditional and alternative investment strategies. He is the main author of the firm’s quarterly publication of investment ideas developed with collaboration with other investment professionals at Francis. Ed also assists plan sponsors and their committees by navigating matters such as plan design, investment manager selection, investment monitoring and ERISA compliance.

Edward Mcllveen

Principal | Chief Investment Officer | Vice President Investment Consulting Services

Finding Balance

Work:

I am all about teamwork. I am thankful that I get to work with a great team committed to making sense of an industry that helps clients looking for simple and clear advice.

Life:

I am a huge family man, but when I have some alone time, I also enjoy running, golfing, reading and traveling.

Money:

Be generous in this life and get ready to pass along your treasures to the next generation.

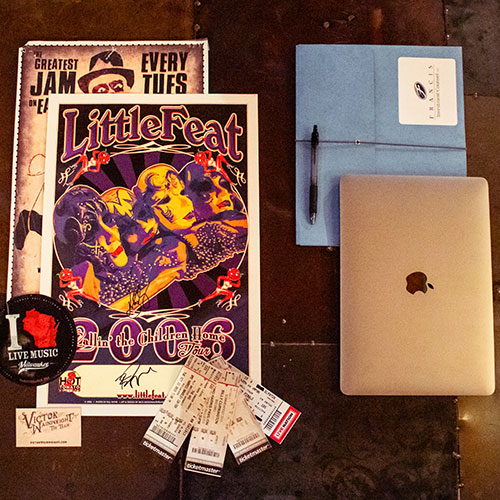

Joseph Topp

Principal | Senior Vice President Investment Consulting Services

- Certifications/Designations: Series 65, Certified Public Accountant (CPA®)

- Education: B.S. Accounting, Marquette University

Joe is one of the founding members of the group that originally formed Francis in 2004. He currently leads the firm’s marketing and business development efforts and is continually looking for ways to create value for organizations and their employees.

More >

X

Joe is one of the founding members of the group that originally formed Francis in 2004. He currently leads the firm’s marketing and business development efforts and is continually looking for ways to create value for organizations and their employees. Before his time at Francis, he served as chief financial officer of a Wisconsin printing operation, allowing him to bring a valuable perspective to his plan sponsors and prospective development efforts. Joe is a member of both the Wisconsin Institute of Certified Public Accountants and Metro Milwaukee Society for Human Resource Management and serves on the board of directors of Wisconsin Retirement Plan Professionals.

Joseph Topp

Principal | Senior Vice President Investment Consulting Services

Finding Balance

Work:

I love that I get to engage with plan sponsors and help them identify ways in which they can enhance their employee retirement benefit programs. Not only are financial coaching services a key to employee success, but Francis’ services stand out in providing excellent money and retirement coaching. I greatly appreciate being a part of a team that positively impacts the financial wellness of thousands of people across the country.

Life:

My recipe for some joy and relaxation includes listening to live music, preferably my favorite band, O.A.R.; smoking Texas style barbecue with experimental rub recipes in my offset smoker; and/or playing pickup basketball games (old man basketball), made all the better when my two adult boys are on the court.

Money:

To help bridge the knowledge gap of financial services, I encourage employers to incorporate supportive and structured financial learning opportunities into their benefits packages.

Sue Salmon

Principal | Director of Operations

- Education: B.S. Education, University of Wisconsin-Milwaukee

Sue oversees Francis’s finance and human resource operations, which typically involves monitoring the daily activities of the firm.

More >

X

Sue oversees Francis’s finance and human resource operations, which typically involves monitoring the daily activities of the firm. She has been in the financial services industry for 40 years, with significant time spent as a branch operations manager for a national brokerage firm. She serves as a liaison between the firm and its service partners, including third-party administrators.

Sue Salmon

Principal | Director of Operations

Finding Balance

Work:

Having a positive impact on those I work with matters to me. Whether it is guiding a new hire through the onboarding process or researching questions for our clients, I find my work at Francis very gratifying.

Life:

I am all about family time. On a Saturday, you can find me watching one of my grandchildren playing youth football or basketball. When it is not about the grandkids, I am with friends playing pickleball, walking my doodle, Cooper, or gardening.

Money:

Pay yourself first! Plan to prioritize your savings and reach your goals.

Kevin Roloff

Principal | Director of Research

- Certifications/Designations: Series 65, Chartered Financial Analyst (CFA®) charterholder

- Education: B.S., business administration, Marquette University

Kevin heads the research team responsible for assessing capital market conditions and investment offerings.

More >

X

Kevin heads the research team responsible for assessing capital market conditions and investment offerings. His team conducts due diligence on investment managers, evaluates opportunities in capital markets and analyzes economic trends. He also leads the team to produce investment manager recommendations and portfolio construction decisions.

Kevin Roloff

Principal | Director of Research

Finding Balance

Work:

My interest in the stock market started in high school but a college internship helped solidify my enthusiasm for the work we do at Francis. Besides being able to fulfill my innate desire to nerd out on investments, I also find it gratifying to help clients accomplish their goals and to operate smoothly despite hazardous conflicts of interest found in the financial industry.

Life:

My life revolves around my three young children, and I wouldn’t have it any other way. When I am not chaperoning trips to the park or pounding an ice cream cone, I am living my best life on the lake, cheering on Marquette basketball or relaxing with my wife (and/or red wine).

Money:

Your success won’t be determined by how you invest or the number of times you meet with an advisor; rather, it depends on how much you can afford to stash away.

Jonathan Nolan

Principal | Vice President Investment Consulting Services

- Certifications/Designations: Chartered Financial Analyst (CFA®) charterholder

- Education: B.S., Business Administration, Marquette University

Jon provides guidance to plan sponsors on all things retirement planning, including investment performance monitoring and asset allocation optimization.

More >

X

Jon provides guidance to plan sponsors in all things retirement planning, including investment performance monitoring, asset allocation optimization, investment manager searches and overall plan benchmarking. He boasts an impressive background in investment manager research, actively covering more than 50 unique investment strategies for the firm. Jon currently serves on the firm’s investment committee, providing insights on global capital markets. Jon is a member of the Marquette University Applied Investment Management (AIM) Program.

Jonathan Nolan

Principal | Vice President Investment Consulting Services

Finding Balance

Work:

I love the fast-paced nature of financial markets and am fascinated by the intertwined web of global economics. I believe plan sponsors and plan participants deserve an advisor that can help make sense of the everchanging landscape of finances without a self-serving motive.

Life:

I am a Midwesterner through and through. Nothing makes me happier than spending time with friends and family in the Northwoods with some good music and a local sports team on in the background.

Money:

Prioritize time in the market over timing of the market. The most successful long-term investment campaigns are those grounded in discipline, especially in the face of short-term volatility.

Kevin Skow

Vice President Retirement Plan Consulting | Regional Director

- Certifications/Designations: Series 65, Certified Pension Consultant (CPC), Qualified Pension Administrator (QPA), Qualified 401(k) Administrator (QKA)

- Education: B.A. Communications, Marquette University

Kevin co-leads Francis’s Minnesota division in the Twin Cities and brings over 25 years of retirement plan recordkeeping

More >

X

Kevin co-leads Francis’s Minnesota division in the Twin Cities and brings over 25 years of retirement plan recordkeeping and consulting experience to his role. Prior to his time at Francis, Kevin was a partner and senior consultant for a large international consulting, actuarial and employee benefits firm.

Kevin Skow

Vice President Retirement Plan Consulting | Regional Director

Finding Balance

Work:

The work we do at Francis matters. It has an impact on tens of thousands of people. There is nothing more gratifying than knowing what you do for a living has an impact and a purpose.

Life:

I live in St. Paul, Minnesota, with my wife and two teenage children, both adopted from the FANA orphanage in Bogota, Colombia. I serve on the board of directors of Friends of FANA Minnesota, an all-volunteer group that provides support for the FANA orphanage and a local resource for families who have adopted children from Colombia. When I am not serving the community, I can be found skiing, golfing, running and waiting for March Madness to come around again.

Money:

Transparency is key. And if it cannot be disclosed clearly, walk away. Don’t be afraid to ask questions about fees and how the people you seek to help you are compensated for their advice and guidance.

Dave Mandel

Vice President Investment Consulting | Regional Director

- Certifications/Designations: Certified Plan Fiduciary Advisor (CPFA); Series 65; ERISA Fiduciary

- Education: B.S. Human Resources Development and Insurance Risk Management, University of Minnesota

Dave is the co-leader of Francis’s Minnesota division. He has over 20 years of retirement plan consulting experience.

More >

X

Dave is the co-leader of Francis’s Minnesota division. He has over 20 years of retirement plan consulting experience, with a special focus on working with plan sponsors to limit fiduciary liability and promote financial wellness initiatives that help foster healthy decision-making. He is a member of a number of local and national associations and is currently involved in his community by serving on multiple municipal boards.

Dave Mandel

Vice President Investment Consulting | Regional Director

Finding Balance

Work:

My passion for helping others is embodied every day at work. Francis gives me the opportunity to make an impact in the lives of others, improve their knowledge and protect the health of many.

Life:

I am all things outdoors. You can catch me hiking, camping, fishing and kayaking. Nature is my favorite way to unwind, especially if it means getting to spend quality time with family.

Money:

It’s never too early to start saving. Investing your money now allows you to have the freedom later, giving you the opportunity to make as many memories how and when you want.

Michael Hartfield

Vice President Retirement Plan Consulting | Regional Director

- Certifications/Designations: Chartered Financial Analyst (CFA®) charterholder; ERISA Fiduciary

- Education: B.S. Applied Mathematics, Texas A&M University; M.S. Applied Statistics, Iowa State University

Michael leads the firm’s southern region. He has led or consulted in every aspect of Human Resources leadership over his 30+ year career.

More >

X

Michael leads the firm’s southern region. He has led or consulted in every aspect of Human Resources leadership over his 30+ year career. He is responsible for developing deep customer relationships with organizations that care about their employees. Michael has been a consulting actuary and served on the 401(k) investment committees of multiple companies.

Michael Hartfield

Vice President Retirement Plan Consulting | Regional Director

Finding Balance

Work:

The professionals at Francis change lives through their conflict-free advice. It is fulfilling to do the right things in the right way, and we get to do that each day for our clients and their employees.

Life:

I love to travel the world with my wife, Tanya, and our two adult children. I usually enjoy playing golf, no matter what the scorecard says, and have a passion for golf course architecture, music, wine, and personal finance.

Money:

Live your best life possible for the least amount of money! Fortunately, the best things in life are free, even if they can be hard at times–kindness and love.

Kasey Miller

Marketing Manager

- Education: B.A. Interdisciplinary Studies, Wheaton College; M.A. Higher Education, Student Development, Wheaton College

Kasey manages the marketing, social media, and public relations efforts of the firm and ensures content effectively communicates Francis’s mission of providing conflict-free and sales-free financial advice and education.

More >

X

Kasey manages content creation and distribution that effectively communicates Francis’s mission of providing conflict-free financial advice, resources, and education. Through marketing, social media, PR, and communications strategies, she promotes a cohesive brand image and voice across all of Francis’s platforms. Coming into her position with a background in higher education, Kasey has a wide breadth of event marketing, program planning, and group facilitation experience.

Kasey Miller

Marketing Manager

Finding Balance

Work:

I enjoy the creative process and the opportunity it allows me to communicate and share Francis’s brand to current and potential clients. My strong belief in the mission of Francis is what drives me to continually find innovative ways to get Francis’ messaging across to potential new clients.

Life:

If you spot me out of the office, I am on the move. Whether it is running, doing yoga, walking with my pup, Athan, or helping my floral-designer friend install wedding florals, I can be found with an oat milk latte in hand and a smile on my face.

Money:

It is OK to have ups and downs in your financial wellness journey. Life is complicated and extending grace to yourself amidst turbulence is the key to being able to weather the ebbs and flows of change.

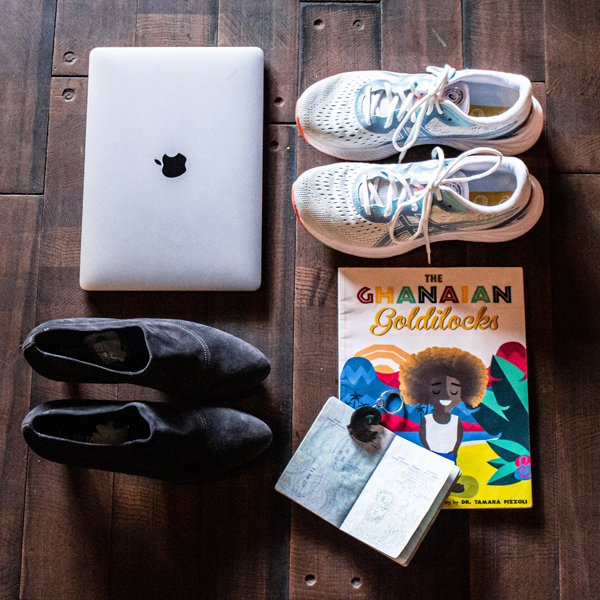

Liz Aidoo

Financial Planner | Director of Inclusive Engagement Strategy

- Certifications/Designations: CERTIFIED FINANCIAL PLANNER™ (CFP®) professional; Series 65; ERISA Fiduciary

- Education: B.A. Communications, Seton Hall University

Liz uses her extensive experience as a bilingual educator to help advise plan participants through the often-confusing world of personal finance.

More >

X

Liz uses her extensive experience as a bilingual educator to help advise plan participants through the often-confusing world of personal finance. She has taught in Costa Rica, Ecuador, Peru, Turkey, Ghana and the United States. She currently sits on the Advisor Institute Council (AIC) for the Defined Contribution Institutional Investment Association (DCIIA) and is a member of their DEI committee. Liz sits on the PLANADVISER Advisory Board and is a member of the working group for the CFERS, Collaborative for Equitable Retirement Savings, project.

Liz Aidoo

Financial Planner | Director of Inclusive Engagement Strategy

Finding Balance

Work:

I love being able to bring my experiences living abroad and being part of a bicultural family into the work that I do. I believe diversity is our strength, and that there is far more that connects us than divides us. Money can be a struggle for all, but being attentive to everyone’s unique needs and goals to create a plan that brings them financial peace is what I enjoy most about my role.

Life:

Managing a dual career household with two young daughters, I find that taking one day at a time helps me focus on the imperfect art of balancing it all. Traveling, spending time in nature and playing guitar are all activities I enjoy, but nothing keeps me more grounded than quality time with my husband and kids.

Money:

Keeping up with the Joneses could be keeping you from meeting your money goals. Think about what matters most to you and let us help you plan to achieve it.

Peter Castro

Financial Planner

- Certifications/Designations: Series 65; CERTIFIED FINANCIAL PLANNER™ (CFP®) professional; Tax Planning Certified Professional (TPCP®)

- Education: B.S. Integrated Ministry Studies, Moody Bible Institute of Chicago

Peter works as a financial planner providing education and individual advisory services.

More >

X

Peter works as a financial planner providing education and individual advisory services. Prior to his time at Francis, he worked in logistics for a national industrial organization.

Peter Castro

Financial Planner

Finding Balance

Work:

I have seen firsthand how money can become such a pain point in life. My desire is to help people take steps to accomplish their goals while taking the confusion and stress out of money management.

Life:

Outside of the office, I can be found enjoying all the seasons Missouri has to offer, despite some of them being a little too short for my liking. Moments enjoying the outdoors with my wife and children are some of the greatest joys in my life.

Money:

Money is not the goal but simply a tool to reach your goals.

Pedro Dominguez

Financial Planner

- Certifications/Designations: Series 65; ERISA Fiduciary

- Education: A.A.S. in Accounting, Madison College

Prior to his time at Francis, Pedro worked as a business analyst for a health insurance company. He joined the team as a Financial Planner after realizing his true passion for personal finance.

More >

X

Prior to his time at Francis, Pedro worked as a business analyst for a health insurance company. He joined the team as a financial planner after realizing his true passion for personal finance. In addition to a drive for helping others, Pedro is bilingual and helps clients and participants navigate their money goals.

Pedro Dominguez

Financial Planner

Finding Balance

Work:

I grew up in a humble, kind and hard-working Hispanic household. My parents taught me the importance of saving money, even though they did not have the knowledge or skills to invest in or build their own financial plan. I am passionate about helping others improve their financial circumstances today and for generations to come by advising them on their money goals.

Life:

My life revolves around my two young children and my partner. Whether it is bike riding on the Great Sauk Trail, enjoying live music overlooking the Wisconsin River or picnicking and cooling off at the splash pad, we love everything that our home of Sauk City has to offer, especially during the summer. When we are not at home, we love exploring new cities and state and national parks.

Money:

Have a safety net cash stash; a three-to-six-month emergency fund will give you peace of mind, help reduce financial stress and prepare you for life’s curveballs. Invest as early in life as you can, keep it simple and automate monthly contributions.

Blake Thomas

Financial Planner

- Certifications/Designations: Series 65; ERISA Fiduciary

- Education: B.S. Practical Ministry, Southeastern University; MA, Intercultural Studies, Fuller Theological Seminary

Blake comes to Francis from a background in community development and Student Affairs.

More >

X

Blake is an incredible educator and brings passion for helping others to every role. As a Financial Planner, he focuses on providing shame-free money advice to individuals from all walks of life and providing practical tips to participants.

Blake Thomas

Financial Planner

Finding Balance

Work:

I didn’t set out to be a financial planner. I simply wanted to pursue a career in which I could help others, and that brought me to Francis. Life is hard and I know what it is like to barely scrape by. When you’re working hard to meet your basic needs it can be difficult to envision what is beyond your immediate vision, but I believe that a solid financial plan can have a generational impact.

Life:

Armchair food critic. Self-proclaimed tequila sommelier. Coffee snob. Gym rat.

Money:

Don’t let shame about your financial situation keep you from seeking help. Sometimes we make mistakes or have unexpected circumstances that impact our finances for years. I know. I’ve been there. But where you are right now isn’t where you have to end.

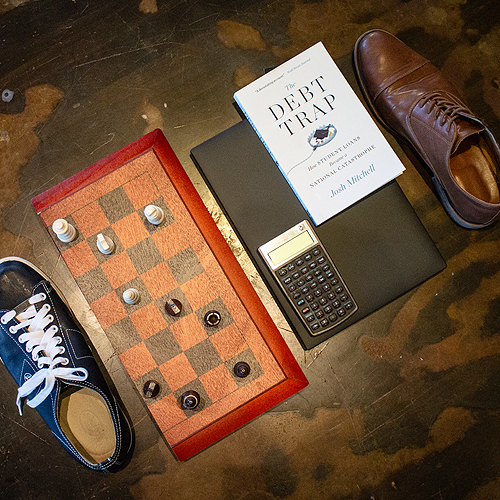

Jamie Rybak

Financial Planner

- Certifications/Designations: Enrolled Agent (EA); CERTIFIED FINANCIAL PLANNER™ Professional (CFP®); Series 65; ERISA Fiduciary

- Education: B.A. Business Administration, Principia College

Jamie serves as a Financial Planner on Francis’s financial wellness team and is responsible for providing education and individual planning services. He also holds an Enrolled Agent (EA) designation and offers tax planning services to participants.

More >

X

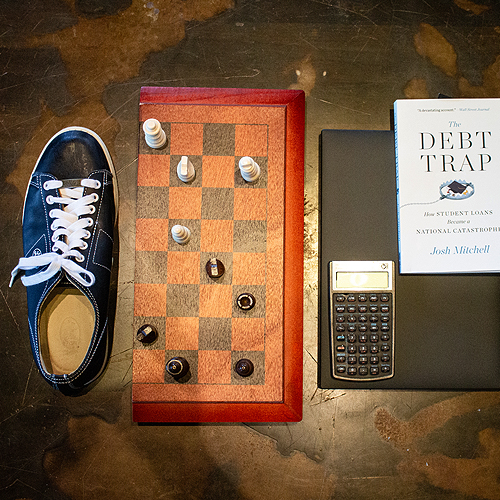

Jamie serves as a Financial Planner on Francis’s financial wellness team and is responsible for providing education and individual planning services. He has worked in the financial industry creating financial plans and delivering advice for almost ten years prior to joining Francis. During his time in the industry, he has achieved the CERTIFIED FINANCIAL PLANNER™ (CFP®) designation, and he holds an Enrolled Agent (EA) designation, allowing him to offer tax planning services to participants. Outside of work, Jamie enjoys music, reading, math, sports, and chess.

Jamie Rybak

Financial Planner

Finding Balance

Work:

I sit on the same side of the table as you to help you figure out how to use your financial resources to achieve your life goals. I specialize in tax planning, but no financial topic is off the table.

Life:

My favorite things in life are chess, music, wrestling, outdoor activities, reading, and spending time with friends and family.

Money:

In school they don’t teach us how to buy a house or calculate our taxes. Instead, we learn how to find the circumference of a circle and identify prime numbers. The finance skills we need for life decisions come from a difference source, and that’s what I’m here to provide.

Vanessa Franco

Financial Planner

- Certifications/Designations: Chartered Financial Consultant® (ChFC®); Notary Public; Series 65; ERISA Fiduciary

- Education: B.S. Financial Planning, William Paterson University

Vanessa is a dedicated Financial Planner with over 12 years of experience in the financial services industry.

More >

X

Vanessa is a dedicated Financial Planner with over 12 years of experience in the financial services industry. She brings a solid foundation of expertise and professionalism to her role. As a bilingual Spanish financial educator, Vanessa provides clear guidance, helping participants make confident, informed financial decisions. Her approach focuses on education, accessibility, and long-term financial wellness. She is an active member of the National DEI Committee of the Financial Planning Association (FPA), where she contributes to advancing inclusive practices within the financial planning profession.

Vanessa Franco

Financial Planner

Finding Balance

Work:

As a first-generation American and the first in my family to receive a college education, I was naturally drawn to helping others navigate the financial system—beginning with my own family. That early experience continues to drive my passion for financial education and empowerment.

Life:

When I am away from work, you can find me grooving at my local skating rink, exploring nature, or spending quality time with my loved ones. I am an avid traveler and have had the privilege of visiting incredible destinations like Italy, Ireland, and Peru. I frequently enjoy traveling to Colombia to spend time with my family and reconnect with my culture.

Money:

Financial freedom may often feel unattainable. Money is a tool we can all learn to use effectively – and with thoughtful, intentional planning, you too can achieve your vision of financial independence.

Matthew Vandre

Financial Planner | Director of Digital Services

- Certifications/Designations: Chartered Financial Consultant® (ChFC®); Series 66; ERISA Fiduciary

- Education: B.A. Socioeconomics, University of Wisconsin-Milwaukee; M.S. Behavioral Finance, University of Alabama; Certificate in Financial Coaching, University of Wisconsin-Madison

Matthew wears many hats, working as a financial planner and Director of Digital Services on the firm’s financial wellness team.

More >

X

Matthew wears many hats, working as Director of Digital Services and financial planner on the firm’s financial wellness team. He is an expert at developing, delivering, and evaluating digital and in-person financial education programs and holistic financial planning services for culturally and economically diverse organizations and families nationwide. He leads a team of internal and external stakeholders to accomplish the vision and ongoing product development of Francis’s unprecedented, AI-enhanced, mobile-optimized, and award-winning financial wellness applications.

Matthew Vandre

Financial Planner | Director of Digital Services

Finding Balance

Work:

Financial decisions affect every aspect of a person’s life for generations. That’s why at Francis, I strive to provide conflict-free fiduciary advice because I know how important it is.

Life:

When I need to recharge my batteries, I like to volunteer my time to the community, spend time with family, attend Sunday worship and retreat to the great outdoors.

Money:

Where your treasure is, there your heart will be also.

Tim Shirk

Financial Planner

- Certifications/Designations: CERTIFIED FINANCIAL PLANNER™ Professional (CFP®); Series 65; ERISA Fiduciary

- Education: B.S. Missionary Aviation Technology, Moody Bible Institute of Chicago

Tim has been helping people from all walks of life reach their retirement goals by providing engaging group education and personalized individual advice since 2006.

More >

X

Tim has been helping people from all walks of life reach their retirement goals by providing engaging group education and personalized individual advice since 2006. He spent his time prior to Francis serving as an aircraft mechanic and flight instructor. His shoe in the door to the business world was working as an operations analyst at a national bank.

Tim Shirk

Financial Planner

Finding Balance

Work:

I joined Francis after a decade of working as an aircraft mechanic and flight instructor in small companies with no retirement plans and without the resources to obtain the assistance I felt I needed to reach my financial goals. I wanted to make sure that same financial resource that I had lacked was made available to others like me.

Life:

I am a lifetime learner-teacher. While it is important to never stop learning, it is wasted if you don’t pass it on. When not passing on what I have learned in finances, you’ll find my nose in an old book, seeking wisdom to pass on to my family as a husband and father, my peers as a friend and my church family as an associate pastor.

Money:

Money, like bread, is only as good as what you do with it. Save too little of it and you might starve. Store up plenty of it, and you can feed others. Hoard it and it will be wasted.

Jay Voigt

Financial Planner

- Certifications/Designations: CERTIFIED FINANCIAL PLANNER™ Professional (CFP®); Series 65; ERISA Fiduciary

- Education: B.S. Business Administration, Cardinal Stritch University; MBA, University of Wisconsin-Whitewater

Jay has extensive experience in financial services, having worked in the industry since 1998.

More >

X

Jay has extensive experience in financial services, having worked in the industry since 1998. He focuses on empowering participants with the tools to successfully manage their holistic financial picture by educating them on the importance of budgeting, saving, investing and managing debt.

Jay Voigt

Financial Planner

Finding Balance

Work:

I live for the “Aha” moments, when participants begin to finally understand credit score, recover from financial mess or successfully manage their retirement plan. I love being able to turn complicated information into useful and understandable material for clients.

Life:

When not in the office, I am still teaching people but on the slopes. I am all about mastering the basics and adapting to changes in the terrain, whether it be finances or the bunny hill.

Money:

Many people overcomplicate money. Simple, well-thought-out plans can help achieve financial goals. The more you simplify your plan, the more likely you are to stick with it.

Macy Fallico

Senior Research Analyst

- Certifications/Designations: Series 65, ERISA Fiduciary

- Education: B.S. Finance and Operations and Supply Chain Management, Marquette University

Macy serves as a research analyst on Francis’ investment consulting team. Her responsibilities include but are not limited to capital market research.

More >

X

Macy serves as a senior research analyst on Francis’ investment consulting team. Her responsibilities include but are not limited to capital market research, client reporting support and investment manager due diligence.

Macy Fallico

Senior Research Analyst

Finding Balance

Work:

I enjoy being able to make a difference in an extremely important area of people’s lives. With strong and unconflicted financial expertise, I am capable of truly changing an individual’s understanding of the financial industry and help them successfully achieve their financial goals.

Life:

When I am out of the office, I can be found riding the trails with my horses or with my friends and family by the lake.

Money:

It is never too late to start planning for your future. One small step can make a huge difference long term.

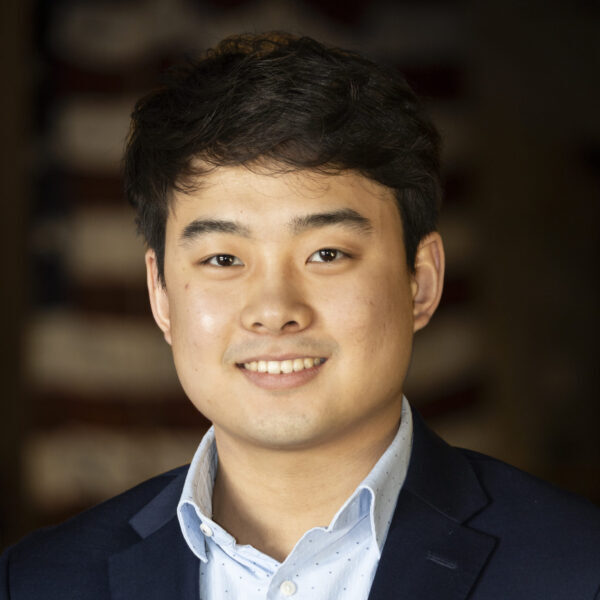

Daniel Kim

Research Analyst

- Education: B.A. Economics, University of Notre Dame

Daniel serves as a research analyst on Francis’ investment consulting team.

More >

X

Daniel serves as a research analyst on Francis’ investment consulting team. His responsibilities include capital market research, investment manager due diligence, and data management and analytics.

Daniel Kim

Research Analyst

Finding Balance

Work:

The world of finance and the broader global economy have always captivated me. Exploring how everything is interconnected and trying to navigate this complex global system is an exciting challenge and is something I want to help others navigate through.

Life:

Staying active is a priority for me. I enjoy being outside and doing any kind of sports, from hiking, lifting, playing football, baseball, or golf. I also enjoy spending time with family and friends.

Money:

Life’s a marathon, not a sprint, and the same goes for money. Patience, consistency, and discipline are the keys to achieving your financial goals.

Sally Gebauer

Financial Wellness Services Manager

- Education: B.A. Religious Studies, Edgewood College

Sally serves as the Financial Wellness Services Manager for Francis’ team of financial planners. She is responsible for coordinating workplace educational programs and financial planning services.

More >

X

Sally serves as the Financial Wellness Services Manager for Francis’ team of financial planners. She is responsible for managing the financial planning services, which include the design and preparation of client campaigns and ongoing educational materials. She also serves as the primary point of contact for clients and plan participants.

Sally Gebauer

Financial Wellness Services Manager

Finding Balance

Work:

Working for an organization that truly cares for its employees and mission makes this position so much more than just a job. I am proud to be a part of this team, of the work that we do, and of the changes that we make in people’s lives.

Life:

I enjoy cooking, which is great, since I also love to eat! I am always eager to try new foods and restaurants. I am active in my parish and happily spend my free time crafting, camping, and with my family.

Money:

If you are like me, you are drawn to a good deal. But, just because something is cheap, does not mean you should buy it.

Madelyn Smith

Financial Wellness Services Coordinator

- Education: B.S. Finance and Marketing, University of Wisconsin-La Crosse

Madelyn aids the Financial Planning team at Francis in coordinating workplace financial wellness services. This involves the preparation of ongoing educational materials and client campaigns.

More >

X

Madelyn uses her top-tier organizational skills and attention to detail to provide support to the Financial Planning team at Francis. She ensures that each Planner has the tools they need to excellently serve our clients and their employees.

Madelyn Smith

Financial Wellness Services Coordinator

Finding Balance

Work:

I am excited to be a part of a team that is passionate about helping others. It is inspiring to work alongside people who truly love their job and are proud of the work that they are doing.

Life:

I come from a big family, so I can never be too busy. I love spending time up north, playing volleyball, CrossFit, and spending time with my friends and family.

Money:

Give every dollar a job; make it work for you!

JOIN THE FRANCIS TEAM

We’re always interested in speaking with individuals who show a high level of integrity, financial expertise, and professionalism in the service of others.

Commitment to Inclusion & Belonging

We value diversity in all forms and celebrate the unique voices of our team members and those we serve. We are dedicated to creating a culture of authenticity and belonging where everyone, from any background, feels respected, valued, and supported.

We recognize that building an inclusive environment is an ongoing journey, and we remain steadfast in our commitment to learning, growing, and moving our firm forward to create the best outcomes for our employees, clients, and participants.

For more information, listen to Elizabeth Aidoo, our Director of Inclusive Engagement Strategy, speak as a panelist on Building Team Culture and Belonging at the 2024 PLANADVISER conference.