Retirement plan administration is more complex than most realize: a constant series of financial transactions bridging

capital flows between payroll, the plan’s investment managers, and participant accounts. Capital traverses these bridges

daily, with money shifting any time there is a contribution to the plan, an investment reallocation, or a participant

distribution request. Atop this entire process sit the plan’s recordkeeper and custodian, service providers hired to create

and maintain this network of transactions, helping plan fiduciaries ensure accurate and timely processing.

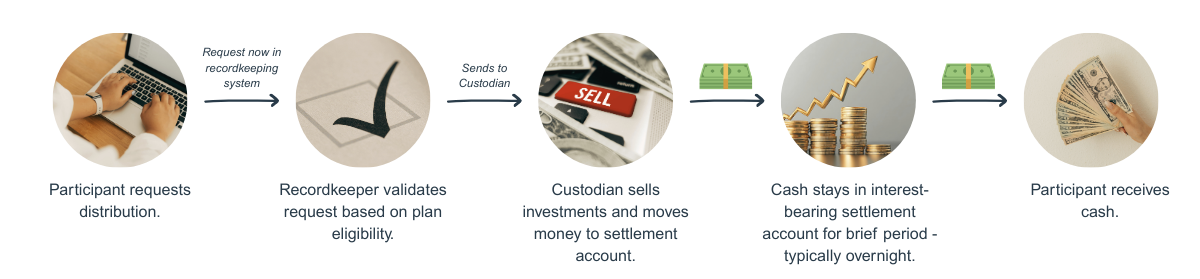

Plan transaction requests are subject to a brief lag between the time of request and the time of settlement. This buffer

allows time for the request to be received by the recordkeeper, positions to be altered by the investment managers, and

funds to be reallocated as requested. Consider the participant distribution request illustrated below:

Between the liquidation of a participant’s investments and the final distribution of requested funds, capital is removed from the plan’s trust account and deposited into an interest-bearing settlement account held by the plan’s recordkeeper, where it generates a generally small amount of “float income.”

Who Does Float Income Belong To?

ERISA makes clear the standard of care for plan assets. Plan assets must be managed and maintained for the exclusive benefit of participants, with participants entitled to any earnings or interest generated from their positions. While it may seem logical for this treatment to hold from the time money is withheld from a participant’s paycheck to the time they’ve completed a distribution from the plan, courts have taken a different stance. A series of complaints in the 2010’s involving corporate plan sponsors like ABB, United Airlines, and Hewlett-Packard1, each using Fidelity as their plan’s recordkeeper, yielded a precedent-setting opinion – assets held in settlement accounts while transferring into or out of the plan do not meet ERISA’s definition of “plan assets.” This ruling gave recordkeepers the legal standing to retain float income as a form of compensation for recordkeeping services.

Plan Fiduciary Responsibilities

Standing behind these court decisions, most recordkeepers retain float income, highlighting their ability to do so in recordkeeping service agreements. For the bulk of the past decade, rock-bottom short-term interest rates made the amount of float income generated within settlement accounts immaterial. This is not the case today, with short-term interest rates hovering around 3.50%, increasing the amount of float income generated, particularly for large plans with a high volume of transaction activity.

To ensure adherence to fiduciary duties under ERISA, plan fiduciaries should: 1) Verify their recordkeeper’s stated practice for handling float income, typically found in their service agreements; 2) If not included on recordkeeper 408(b)(2) fee disclosure statements, request disclosure of float income generated by the plan and retained by the recordkeeper; 3) Document any float income retained as a part of total recordkeeper compensation when evaluating the overall reasonableness of recordkeeping fees; and 4) Renegotiate recordkeeping fees if deemed unreasonable.

1Tussey v. ABB, re Fidelity ERISA Float Litigation

The information contained herein is provided for informational purposes only. The information provided is from sources we believe to be reliable, but we cannot guarantee its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Francis LLC does not offer personal legal advice.