Most U.S. retirement plans offer participants an investment alternative designed to provide capital preservation. Both money market and stable value funds fit this objective as they allow invested capital to remain daily liquid, earn a market-determined rate of interest, and remain at a fixed net asset value (NAV). While these two investment products serve the same purpose, their returns are driven by very different investment strategies. It is also important to know there are contractual restrictions that make it very difficult for plan sponsors to offer both of these vehicles in a plan’s investment menu simultaneously or easily switch between the two.

Money market funds are comprised of ultra short-term debt securities (maturity of 90 days or less), predominately issued by the U.S. government. Given their extremely short maturity profile, these strategies are highly responsive to changes in short-term interest rates, both when rates rise and when they fall. Because a money market fund is comprised of individual securities with ultra-short maturities and U.S. government backing, it has virtually no market risk and allows investors daily access at a fixed NAV.

Stable value funds employ a very different strategy, one that has proven so attractive, the SEC has restricted access to qualified retirement plan investors only. These strategies invest in intermediate-term bonds (1-5 years) issued by both the U.S. government and U.S. corporations, with an average portfolio maturity around 3 years. Stable value managers then contract with multiple insurance companies to “wrap” their intermediate-term bond portfolio, insuring investors against short-term fluctuations in market price due to changes in interest rates and credit quality. Because of this insurance, the SEC allows stable value fund providers to offer this product with a “stable” or non-fluctuating NAV. This allows investors the ability to withdraw money on a daily basis at a fixed NAV, even during periods where the portfolio has experienced short-term losses.

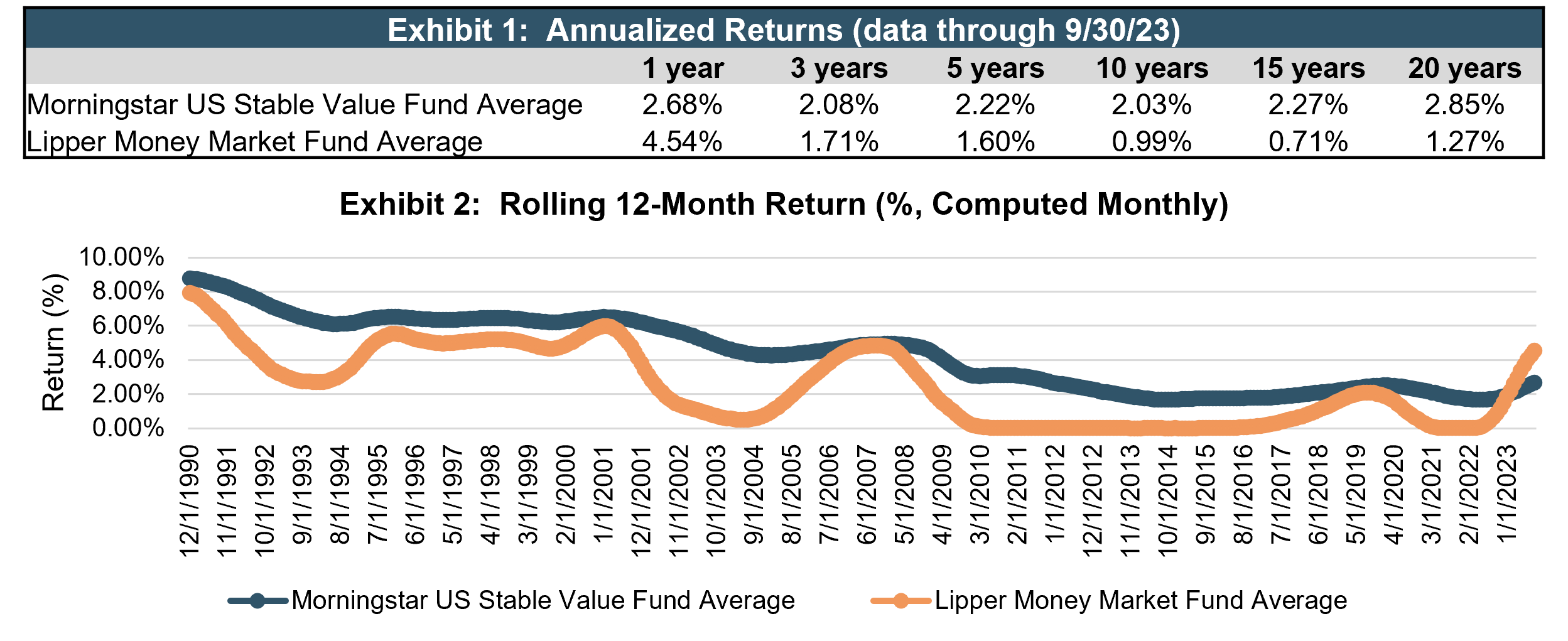

For long-term investors, stable value funds offer a compelling advantage. In most economic environments, the U.S. yield curve is upward sloping (longer-term bonds pay more in interest than shorter-term bonds) and yields are fairly stable. In these periods, the ability to invest in longer-term bonds, but still offer participants a stable NAV, has resulted in both higher and more consistent returns (Exhibit 1).

That said, in periods of rapidly rising short-term interest rates and inverted yield curves, like the one we’ve experienced since early 2022, stable value funds will adjust to higher short-term market rates much slower than will money market funds. As shown in Exhibit 2, stable value funds outperform money market funds in the vast majority of 12-month periods dating back to the early-1990’s, with money market funds catching up in periods of U.S. monetary tightening (2000, 2004-2007, 2016-2019, 2022) but trailing substantially in, and following, periods of U.S. monetary accommodation (2001, 2008, 2020).

To protect shareholders against interest rate arbitragers, all stable value funds require plan sponsors sign a contract restricting them from offering a competing fund such as a money market fund or from moving all assets to a money market fund without first providing a 12-month notice. Saving for retirement is a long-term journey, so despite these restrictions and today’s high short-term rates (5.0%+), we favor the long-term yield advantage of a stable value fund for inclusion in qualified plan menus.

Exhibit Sources: Morningstar, Lipper, via StyleAdvisor

Disclaimer: the summary/prices/quotes/statistics contained herein have been obtained from sources believed reliable but are not necessarily complete and cannot be guaranteed. Annual, cumulative and annualized total returns are calculated assuming reinvestment of dividends and income plus capital appreciation. Past performance results are not necessarily indicative of future results. Francis LLC does not provide tax or legal advice. Please consult your tax and/or legal advisor for such guidance.